Aligned Sustainability

Project 2050

The 2050 System

The 2050 System is based on the following observation:

#1 Investing is not about wondering where the wind goes, but blowing it where we wish to go. Investors shape the future through their choices and actions: investing in one company over another empowers it to shape tomorrow’s society; supporting a founder means enabling his or her mission and spreading his or her values. It is therefore a performative, self-fulfilling choice or — simply put — a choice of society. So the real question is: which future should we finance? Here’s our take. We want to finance a fertile future. A future that is productive and inventive, creating wealth and opportunities for everyone. Evolving and resilient by nature, easily adapting to the environmental, social and technological mutations. Inclusive and diverse, empowering everyone to find their unique place and their own solutions, relevant to the places they live in. 2050’s mission consists in steering money to build that fertile future which will secure the key essential goals (the Essentials) of our time for everyone by 2050:

- eat enough and healthfully

- take care of body and mind

- empower learning and creativity

- live and produce sustainably and

- put trust at the heart of the economy.

#2 To this end, 2050 System has been designed to give life, confidence and human, technological, legal, cultural and financial resources – in a word the power to act – to those who work to realign their action with these 5 Essentials. In particular, to support the emergence of companies aligning their business interests together with those of society and the planet, thanks to aligned business models, governance, management, risk and valorisation methods assessing every company’s triple performance (financial, environmental and social) and global risk profile (the “Aligned Companies”).

#3 It is therefore necessary to develop aligned ecosystems around each company financed, the 2050 System itself, and more generally around the Essentials. It happens through the funding and support of shared resources enabling the stakeholders in these ecosystems to collaborate, innovate, share their knowledge, develop material, human or immaterial open infrastructures, advocate for alignment practices or solutions contributing to the Essentials (the “Ecosystem Assets”). The activities of research, promotion, democratization of financing models, governance, and valuation of Aligned Companies and/or Ecosystem Assets themselves represent Ecosystem Assets, just like the perpetuation of their financing method within the 2050 System.

Based on this observation, the 2050 System wants to create the conditions for its fertile growth, its resilience and to nourish its own ecosystem. To date, this dynamic has materialized in the form of:

- 2050.do, a French simplified stock company (société par actions simplifiée) hosting the team leading the 2050 System. In order to ensure the stability of its shareholding, its continuity, and the uninterrupted pursuit of its objectives, 2050.do is controlled by a French legal structure known as a perpetual purpose trust (fonds de pérennité) named 2050.stewards. Besides, 2050.do supports the development of open and strategic resources (open research and knowledge, advocacy, common infrastructures) for its portfolio and ecosystem, including through the launch and financing of 2050.commons, a French association governed by the French law of 1901, whose founders are 2050.do and 2050.stewards and financed by a membership paid by 2050.do as an active member.

- 2050.ventures, an evergreen fund in the form of a French Special Limited Partnership (Société de Libre Partenariat) designed to invest in the companies selected by 2050.do in application of its investment strategy and supplemented, where appropriate, by dedicated co-investment vehicles managed by 2050.do. 2050.ventures is an article 9(2) fund pursuant to SFDR regulations.

- 2050.coinvest and its compartments W2 and Serapis. 2050.coinvest was set up to enable 2050.do to offer the opportunity to co-invest along 2050.ventures whenever an Aligned Company’s funding needs would exceed 2050.ventures allotted ticket. Hence the umbrella fund and each of its compartment were designed to invest in Aligned Companies with a social sustainable objective. However, for ease of fund management and to avoid doubling the work on integration of sustainability risk as well as the reporting work, 2050.coinvest and both its compartments classify as Article 6

- 2050.coinvest compartment W2 was set up to co-invest in Withings.

- 2050.coinvest compartment Serapis was designed to co-invest in Fifteen.

Alignment Framework

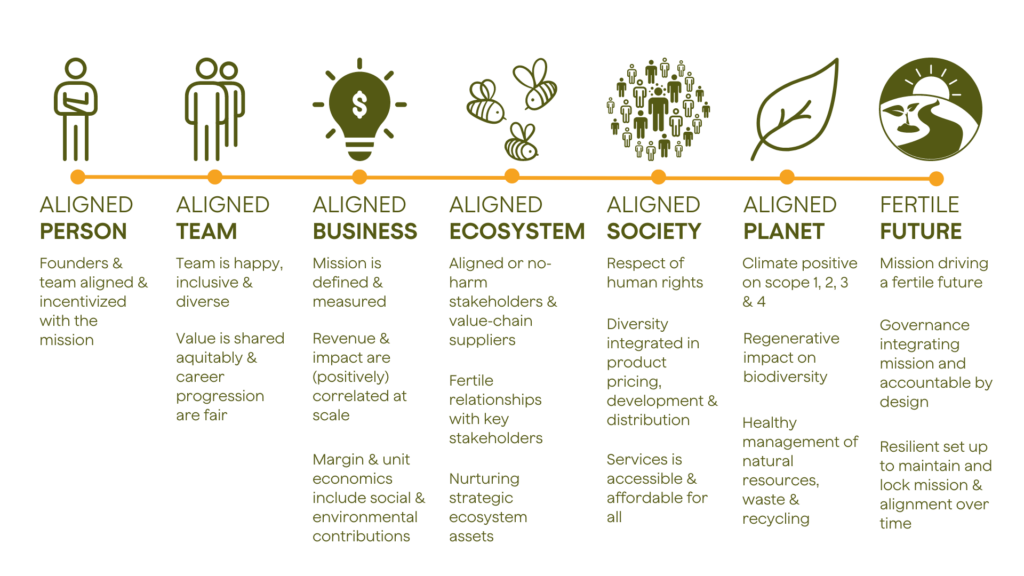

2050.do develops, together with the venture builder We Are Human, co-founders of Kahoot!, its sustainability framework named Alignment Method based on seven sustainability indicators “2050 Key Alignment indicators (KAI)”, and which will be shared as open source methods.

Alignment is a strategic framework enabling founders, management and board alignment on long-term and holistic strategy, mission and goals, and on back-casted medium and short-term goals. It naturally results in a decision-making framework including Key Alignment Performance Indicators which are used to ensure the company’s alignment is maintained from a strategic operational and compliance standpoint. Detailed KAPIs therefore integrate in-house alignment indicators, positive and adverse impact indicators, including Principal Adverse Impact (PAI) on sustainability factors set out in the Regulatory Technical Standard (RTS) of the SFDR, augmented by some ESG, PRI and sustainability risks indicators as well as selected SFDR or CSRD compliance requirements. These indicators are chosen from

- the most advanced impact frameworks, including the Earth System Impact and the Essential Environmental Impact Variables from the Stockholm Resilience Center, and the Doughnut Economics Action Lab open access tools,

- SFDR Article 9 as well as EU taxonomy related indicators, including PAI, DNSH and Minimum Social Safeguards,

- PRI and other relevant ESG frameworks.

These KAIs are used by 2050 to select portfolio’s companies and help them to define a dedicated alignment plan with tailored objectives. The portfolio sustainability risk and opportunities are assessed through the KAIs. The sustainable investment objective of the Fund is measured by determining both the level of alignment of the Fund’s portfolio companies, and the level of achievement of 2050’s mission through the measurement of the aggregated net impact of the 2050.ventures’ portfolio on the Essentials.

The Alignment and KAI will be enriched through the advancement of the joint project together with We Are Human on an open-source basis.

Please note that our set of KAIs and the sustainability data we gather from our portfolio companies will be amended regularly, to reflect regulation changes, progress on impact valuation or sustainability risks assessment, improvement of Alignment or additional focus of the Fund on specific matters.

Sustainability related disclosures

Responsible Investment Policy

For 2050, investors shape the future through their choices and actions: investing in one company rather than another gives it the power to shape tomorrow’s society; supporting an entrepreneur means carrying out his or her mission and spreading their values.

The 2050 system has been designed to shape a fertile future.

This Responsible Investment Policy outlines the guiding principles, key strategies, and structural frameworks that 2050.do employs to achieve its sustainable investment goals. It represents our commitment to incorporating KAIs considerations into our investment decisions. These principles and frameworks form the foundation for our impact Key Alignement Indicators (KAIs), ensuring our investments deliver triple performance (financial, environmental and social).

2050.ventures website disclosure

2050.ventures promotes a holistic approach to sustainability and pursues a triple objective of creating financial, environmental and social value by investing into companies that are sustainable by design.

2050.ventures is a fund under Article 9(2) of the Sustainable Finance Disclosure Regulation (SFDR). This regulation mandates sustainability disclosure obligations for fund managers to their end-investors.

Principal Adverse Impact (PAI) statement

- PAI not taken into account at entity level (2050.do)

The Management Company does not take into account the principal adverse impacts of investment decisions on sustainability factors (“PAI“), as defined in and within the scope of Articles 4 of the SFDR Regulation.

Rather the Management Company applies the Alignment Framework to itself to ensure it is an Aligned Company.

Given the size of the Management Company (less than 500 employees and less than 500 AUM), 2050.do has chosen to adopt a best effort and comply or explain approach to assessing the main negative impacts.

Given also the stage of development of the various funds managed by 2050.do, the Management Company has chosen to select the most relevant indicators proposed by the Disclosure Regulation. Gradually, the Management Company will interact with the relevant Enterprises to increase the volume and quantity of sustainability data, thus tending towards a complete inventory of the main negative impacts. Principal Adverse Impacts on Sustainability Factors are taken into account by the Fund.

- PAI at fund level (2050.ventures)

The Fund takes into account the PAI on the investment decisions. The sustainability indicators are integrated into the Fund’s investment process as a manner to contribute to the achievement of the sustainable investment objective. In addition, adverse impacts on sustainability factors are identified through the alignment framework. Information on the investment decisions’ PAI will be made available on an annual basis in the Fund’s annual report.