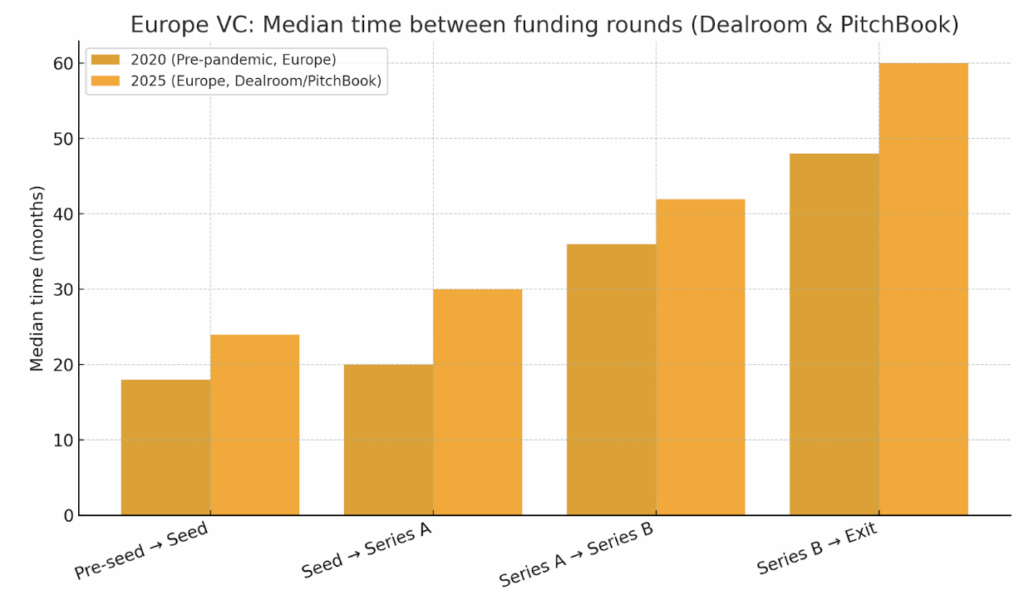

When Klarna raised a fresh round in 2022 at half its previous valuation, investors hoped the Swedish fintech would soon tap the public markets. Three years later, the IPO window finally opened for the Europe’s most valuable fintech that had to rely on secondary share sales in between to ease pressure on early backers. If things finally paid off for Klarna, it looks like an isolated case: from Revolut in London to Back Market in Paris, Europe’s unicorns are getting older, their fundraising cycles longer, and their investors increasingly impatient. According to Dealroom and PitchBook, the median time between venture rounds in Europe reached 696 days in Q2 2025 — nearly two years without new capital, up 5% year-on-year. What once looked like a cyclical hiccup now appears as a structural transformation: Europe’s startups are stuck in extended limbo, and LPs are stuck with locked-up capital. A state that requires more runway for startups but also a clearer and faster path to profitability. Here’s the detailed state of the market by deal size.

Pre-seed → Seed: bridges become the norm

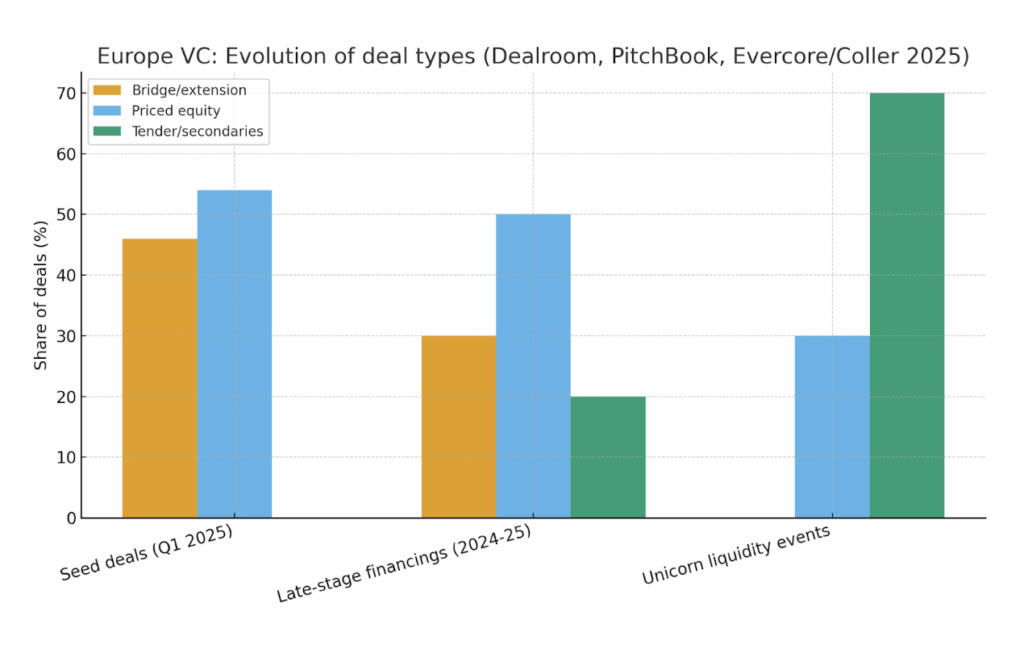

At the earliest stage, the wait before institutional money arrives is lengthening. Across Europe, the median interval from pre-seed to seed now exceeds 24 months, compared with ~18 months in 2019 (Dealroom Europe Q1 2025 Report). To survive, founders rely on bridge rounds, convertible notes, and public grants. In Q1 2025, 46% of all seed financings were bridges rather than priced rounds. Take Planet A Foods (Berlin), maker of cocoa-free chocolate “ChoViva”. The startup spent nearly three years between its first angel cheques and its 2022 seed round, financed in the meantime by EU sustainability grants and convertible notes. This illustrates how VCs are outsourcing risk: angels and public schemes absorb the uncertainty, while institutional investors wait for proof points.

Seed → Series A: the widening valley of death

The critical bottleneck is moving from seed to Series A. Europe’s median time reached 774 days (25.4 months) by late 2024, while fintech startups endure 971 days (2.7 years), about 25% longer than the all-sector median. Series A investors increasingly expect quasi-growth metrics, often demanding profitability.

Swedish fintech Anyfin, which helps consumers refinance credit, was seeded in 2018 but had to wait until 2020 for its €30 million Series A, led by EQT Ventures and Northzone. For three years it survived mainly on revenue and small interim financings. The widening gap reflects investor caution: “Series A do not rely on product market fit and traction solely anymore. Companies now need to show foreseeable profitable unit economics and demonstrable scaling capacity on top. To do so, they often conclude strong strategic partnerships to accelerate demand and time to market. A good example is Paebbl who welcomed Holcim and Amazon on its Series A cap table and concluded commercial agreements at the same time” explains Marie Ekeland, founder of 2050.

Series A → Series B: delayed validation, tougher terms

Series B rounds are also slowing. PitchBook shows the median time from first VC check to Series B now stretches to 5.8 years in Europe, compared with ~4 years pre-2020. Delays translate into bridget rounds, structured equity, and liquidation preferences. Carta’s Q2 2025 Private Markets Report shows the amplitude of this trend worldwide “In Q2, the longest gap between rounds was found at Series B, where the median startup had waited 800 days (about 26 months) since its Series A.” Looking closer, it underlines the very different dynamic between primary & bridge rounds: At Series B, median primary and bridge valuations are moving in different directions. In primary rounds, the median pre-money valuation on Carta climbed to $120 million in Q2, a 15% quarter-over-quarter increase. On bridge rounds, the median pre-money valuation dropped to $79.7 million, a 13% QoQ decline. The median Series B primary valuation is 50% higher today than it was two years ago, while the median Series B bridge valuation has fallen by 34% over that same period.”

Series B → Exit: the mid-stage drag

The slowdown is most punishing at the late stage. Companies that reach Series B now face 3–4 years before another priced round or liquidity event. The consequence: a rise in structured growth rounds, secondary blocks, and extension financings. British AI-chipmaker Graphcore is a cautionary tale. After raising a $200 million Series D in 2018, later financings were repeatedly delayed. By 2023–24, revenue shortfalls forced layoffs and reliance on interim capital rather than fresh equity. Its case highlights how European deeptech companies, capital-intensive by nature, are most exposed to longer timelines.

Unicorns: Europe’s ageing stock of private assets

Demographics reveal the depth of the problem. Dealroom finds the median age of European unicorns is now ~8 years, with 40% at least nine years old. The U.S. mirrors this with 8.5 years and 45% respectively. Sweden’s Klarna, founded in 2005, remained private until two decades later and after multiple down rounds, relying on secondary share sales for liquidity until this month’s IPO. UK-based Revolut, launched in 2015, has crossed the 10-year mark without an IPO, despite a valuation near €30 billion (WSJ, June 2024). These companies illustrate how tender offers and secondary transactions, rather than IPOs, sustain Europe’s unicorn cohort. “You can see how a new generation of entrepreneurs is following the path set by the Collison brothers, founders of Stripe, of finding liquidity solutions for their shareholders in the private markets, instead of accepting the short-term pressure of public markets like historical European unicorns (Spotify, Criteo…) did. I expect to see more and more liquidity solutions coming from the diverse private equity asset classes including buy-outs and secondaries. In a convergent dynamic, you can already see once public companies deciding to become private again, like Believe in France.” adds Ekeland.

LP consequences: secondaries as pressure valves

For LPs, prolonged timelines mean fewer cash returns even as GPs keep calling capital. Evercore estimates $160 billion in global secondary volume in 2024, with growth projected at 9.2% annually to 2029. Europe is increasingly active: EQT and Ardian have launched continuation vehicles for mature assets, while U.S. precedents like Sequoia’s $861 million Stripe secondary (Sifted, Sept. 2024) set the tone. Yet the math is sobering. With unicorns valued at trillions, secondaries—even at record levels—cover only a fraction. LPs must either accept discounts of 30–50% to NAV or extend their holding horizons.

Another way is to build Evergreen structures which are now Europe’s main innovation to reconcile liquidity and long-cycle innovation. Unlike the 10-year closed-end model, they offer continuous fundraising and periodic redemption. PitchBook forecasts European evergreen VC/PE AUM could double from <€90 billion in 2024 to >€140 billion in 2029. France is leading: Ardian Infrastructure Evergreen Fund, Geneo Capital Entrepreneur, and 2050 invest in sustainable innovation while offering LPs liquidity windows. Sweden’s Gullspang Re:food applies the model to food tech. As Ekeland argued in Les Échos (Apr. 2023), the goal is to align “the long time of sustainable innovation with the flexible liquidity investors require.”

The lengthening intervals between venture rounds are no longer a blip in the cycle but the new normal for Europe’s startups. From bridges at seed to extensions at late stage and tenders at unicorn level, liquidity has become the defining issue in venture capital. For LPs, this means more capital trapped in ageing portfolios, fewer distributions to reinvest, and a growing dependence on secondaries. Evergreen structures, born on the margins, are quickly moving centre stage — not as a fad, but as a survival mechanism for an ecosystem running out of time. The real question for investors is not whether venture capital will adapt, but whether they can afford to wait as long as startups now must.