In the rarefied world of private equity, one word has become almost obsessive: liquidity. After a decade of exuberance—sky-high valuations, a flood of capital, and an IPO conveyor belt that seemed unending—the sudden halt in exits since 2022 has shaken the industry’s certainties. In the US, Axios recently reported that nearly one-third of VC funds raised in 2017 had still returned zero dollars to investors by March 2024—a stark awakening for Limited Partners long used to predictable distributions. “DPI is the new IRR,” quipped Tristan Tully of Brookfield at a Paris conference—plain English for “cash return now matters more than lofty performance metrics.” Once the classic closed-end model was celebrated for discipline; today, it’s groaning under its inflexibility. Once celebrated as the perfect marriage of so-called patience and performance, it suddenly looks outdated in an age where exits have dried up and capital has become scarcer.

The Venture Capital Liquidity Drought

Since the speculative peak of 2021, IPO windows across the US and Europe have remained stubbornly shut, while strategic M&A activity slowed to a trickle. PitchBook calculates that VC distribution rates relative to unrealized value have hit their lowest since the global financial crisis. Meanwhile, a backlog of unicorns builds: nearly two-thirds of US unicorns received their first VC check more than seven years ago, yet remain private and trapped in portfolios.

The stalemate has turned the spotlight on the secondary market. Estimated at $60 billion in 2025, up from $50 billion in 2024, secondaries have never been more in demand. And yet, for all the headlines around Stripe’s tender offers or Anthropic’s meteoric valuations, they still represent less than 2% of unicorn value. A drop in the ocean.

The pressure is palpable. Intel Capital has signaled it will shed its bloated venture holdings. Startups themselves are running tender offers to appease restive employees. Ramp, Whatnot, Stripe—names that symbolise both innovation and fragility.

As John Avirett, partner at StepStone, put it in an interview with Venture Capital Journal — cited in the Secondaries analysis by 2050 report — “LPs’ appetite for liquidity is the main driver of growth in the secondary market. This is just the start of a domino effect.”

Evergreen as the New Social Contract

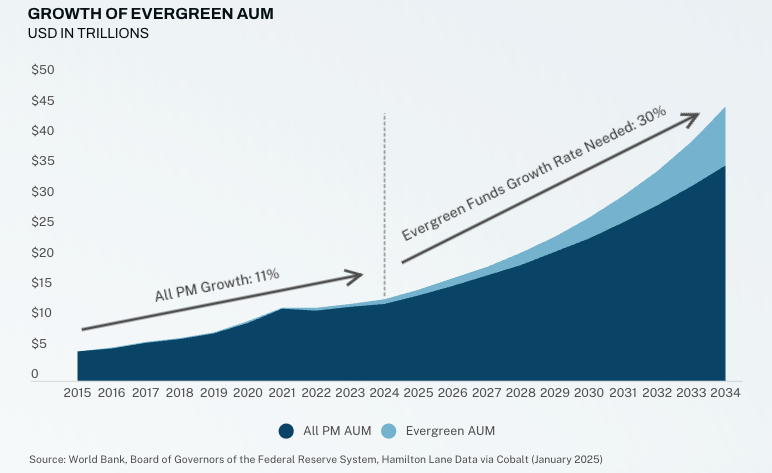

In this context, evergreen funds now appear less as curiosities and more as structural remedies to systemic illiquidity. PitchBook reports that funds with indefinite life under management totaled $2.7 trillion by end-2024, expected to climb to $4.4 trillion by 2029.

The proposition is disarmingly simple: no artificial expiry, no sudden rush for exits, just open-ended participation with liquidity windows along the way. The promise of “patient capital” and “flexible liquidity” in the same vehicle. Two worlds once thought irreconcilable.

For institutions and wealthy individuals, the appeal is obvious. No more unpredictable capital calls. No more waiting a decade for an arbitrarily scheduled distribution. Instead, continuous fundraising, partial liquidity, smoother operations.

Europe’s ELTIF 2.0 framework has poured fuel on this fire. Hamilton Lane has launched an evergreen ELTIF. In Paris, Ardian is extending its model to infrastructure; Geneo is experimenting in growth capital. Funds like Übermorgen, Gullspång or EQT Ventures are trying it out in sustainable venture. Even Sequoia, the Silicon Valley giant, has gone evergreen—a pivot that says more than any press release.

The Mirage and Reality of Returns

But investors are no fools. They ask: is it working?

The numbers whisper “yes, but carefully.” According to PitchBook, over the 12 months ending in April 2025, private equity evergreen funds posted a median return of 13.8%, well above private debt (7.8%) and real estate (3%). Yet returns remain uneven. Secondary-heavy strategies often shine brightly at first but may fade with time.

Despite a couple bad trajectories, evergreen’s ability to nurture portfolios with mature assets through secondaries offers a unique strength: less deep in the J-curve, more early distributions. Partners Group pioneered this in 2009; now KKR and StepStone are following.

Coller Capital’s Global Private Capital Barometer shows that 37% of LPs will boost secondaries allocation in the coming year. A clear signal: in an exit-starved world, secondaries are no longer optional. They are central. Hamilton Lane’s 2025 evergreen venture-secondaries hybrid is not an experiment. It’s a blueprint.

The Private Wealth Revolution

Yet the real engine of evergreen is private wealth.

Bain & Company estimates individuals control about $150 trillion in assets, on par with institutions, but barely touch private markets. That gap is irresistible. Blackstone, Apollo, KKR, Carlyle, Hamilton Lane—all have rolled out perpetual strategies for wealth clients. CAIS and iCapital make them accessible with a few clicks.

Far from retreating, family offices are emerging as the natural constituency for evergreen structures, driven by their appetite for legacy-oriented, impact-led investing. UBS’s Global Family Office Report 2025 shows they remain heavily invested in private markets—averaging 21% of portfolios—and are increasingly seeking strategies that blend patient capital with measurable social impact, especially across climate, health, and equity sectors.

Across Europe and Asia, the refrain is growing louder: capital must align with values, not just returns. What was once a niche preference for mission-driven investing is now a core decision-making lens for passports of the next generation. As one NextGen member at UBS put it: “Educating the next generation on how to navigate wealth responsibly is a job for all involved.”

Europe’s Strategic Advantage — and BlackRock’s Game-Changer

Ironically, Europe—long seen as timid in private equity—may find itself leading on evergreen. ELTIF 2.0 has given Brussels an unlikely edge.

Ardian, Geneo, 2050—each is experimenting. But the real turning point came in late 2024. BlackRock, the $10 trillion behemoth, unveiled an evergreen platform under ELTIF 2.0 for wealth clients. Not just Europe, but also the Middle East and Asia-Pacific.

Two funds launched: one in private equity, one in multi-alternatives. Luxembourg SICAV meets ELTIF 2.0. Stephen Cohen, BlackRock’s chief product officer, declared: “Our goal is to revolutionise access to private markets for wealth clients… making institutional-quality alternatives accessible to a wider range of investors.”

Symbolism matters. When the largest asset manager bets on perpetual structures, evergreen is no longer a side project. With Blackstone, BNP Paribas AM and HarbourVest close behind, it’s being institutionalized.

For LPs, the stakes are clear. Preqin expects alternatives to exceed $30 trillion by 2030. BlackRock argues portfolios could support up to 20% in private markets. The democratization of private equity is finally moving from slogan to structure.

HSBC is no bystander either. “Evergreen is a game-changer,” insists Mathieu Forcioli, Global & APAC Head of Alternatives at HSBC Private Bank. Such structures, he says, are unlocking client wealth for private markets at ticket sizes once thought impossible, especially as rates soften.

A Trial By Fire in Volatile Markets

And yet, no fairy tales here. Evergreen funds are still untested in truly rough seas. 2022 offered a warning, when US non-listed REITs capped redemptions to survive. Secondaries Investor called it a “trial by fire”. The truth is blunt: liquidity promises in private equity are always conditional. Underlying assets stay illiquid.

The smarter managers know it. They tighten redemption rules, impose gates, lengthen notice periods. Evergreen may smooth the experience, but it does not turn private equity into an ETF. LPs know this. Or they should.

Toward the Institutionalization of Permanence

Despite the challenges, the trajectory is unmistakable. PitchBook projects that evergreen private equity funds will more than double by 2029—surpassing $500 billion. Wealth-focused evergreen may grow 20% annually, crossing the trillion-dollar threshold.

In an age of permacrisis—wars, inflation, geopolitical volatility—the demand for a new social contract between capital and liquidity has never been clearer. Evergreen is no miracle. But it is the most credible attempt yet to reconcile long-term innovation cycles with short-term investor needs.

And the industry itself knows the rules of the game have changed. As Blackstone’s leadership recently noted in an interview with the Wall Street Journal, “we’re seeing our highest fund appreciation in nearly four years,” signaling that the liquidity freeze of the early 2020s is giving way to a new cycle of capital recycling. Meanwhile, the secondary market, once considered a backwater, has become the industry’s safety valve. As Business Insider pointed out: “In 2024, the market reached a record $160 billion, with projections of $220 billion in 2025.”

The message is clear: liquidity will never again be addressed in the same way. For LPs, the choice is not whether evergreen will matter, but how to embrace it. Do they board the massive ships—BlackRock, Blackstone, Apollo—that now dominate the ocean? Or do they back smaller, specialist navigators, betting on AI, climate, or healthcare as tomorrow’s safe harbors? Both strategies should pay off in the long run.

One thing is certain: evergreen has escaped the margins. It is fast becoming the format through which the next chapter of private equity will be written. For those searching for conviction and flexibility, permanence and liquidity, the era has already begun.