Power frameworks, photo by Marie Ekeland

Little did we know, when starting 2050, how many of the innovations we were bringing to the VC world would be legal innovations. But we soon realized it 🙂

Why, will you ask me? Because legal frameworks have been optimized throughout the years for existing models and that whenever you apply a different logic, they are often unadapted.

And, guess what? Our logic is radically different. Indeeed, we are not looking at the past to identify VC patterns & best practices in order to reproduce them. Instead, we are aiming to craft a fertile future by understanding how we can contribute to accelerate market shifts and investing in transition-leading companies and ecosystems. Very different.

Starting from this goal, and digging into how to execute it, we have come up with a model relying on three major innovations: one in its investment strategy, another in its fund structure and the last in its governance.

- We support open & strategic resources: In addition to investing in tomorrow’s aligned champions, we also finance open & strategic resources to accelerate their ecosystem mutation and market shift. That would be research, shared knowledge, advocacy, open data or open source infrastructures…

- We have structured an evergreen fund: To empower founders in choosing the right development strategy for their company (without external liquidity constraints), and investors in deciding, as much as possible, their own liquidity timeframe, we have structured an open-ended fund, building liquidity at the fund level. This also allows all stakeholders to be aligned on the performance of the ecosystem as a whole.

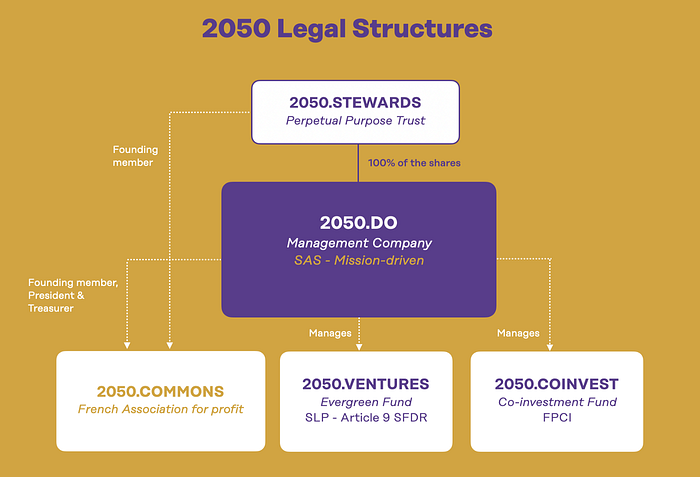

- We are ecosystem-governed: We are not a partnership but a company governed by its stakeholders acting as stewards. Indeed, to guarantee the long-term alignment of our mission and our investment strategy, we designed 2050 as the first management company to be 100% owned by a perpetual purpose trust (“fonds de pérennité”), and governed as a stewards-ownership.

Today, we have succeeded in building the means and foundations to reach our goal. Implementing all these innovations has taken us a lot of time, energy & creativity and we would have never managed to make it happen without the precious advices and support from our talented lawyers ranging from fund structuring (Christophe Baert from CBCH Associés, Rima Maitrehenry from Racine), corporate tax (Matthieu Chernet from Upgrade, Olivier Couraud from Stephenson Harwood), corporate M&A (Guillaume Briant & Babacar Diop from Stephenson Harwood) and non-profit organizations (Xavier Delsol & Arnaud Laroche from Delsol).

And, of course, as an aligned company ourselves, we have embraced the most demanding SFDR regulations on our evergreen fund (Article 9). Our objective is to strategize them in order to help our companies align at best their business interests with those of society and the planet. In short, leveraging compliance and ESG as strengths within our portfolio as well.

You have the picture now: legal, compliance & ESG topics are numerous, diverse, demanding, innovative and strategic within 2050. To pilot all those and put them at the service of a fertile future, we needed someone who had mastered corporate law, private equity transactions, sustainable financing, fund structuring, compliance & ESG and navigated well in corporate tax & non-profit legal frameworks. In an international environment. With an agile, creative, business-oriented, mission-driven & problem-solving mindset.

Impossible you think? Not for Lorraine Artur de la Villarmois. We are so happy to welcome her on board as our Head of Legal & ESG :). Having started her career in corporate M&A in Paris, built her legal translation business in Vietnam and mastered ESG, compliance & fund management in Myanmar during Covid-19 and a coup d’état, Lorraine is our new force!