Founded in 2021 by a team of experienced European scientists, engineers and entrepreneurs, Paebbl produces carbon-storing materials to turn heavy CO2 emitting industries into CO2 sequestering industries. Its mineralization process has already been applied successfully to construction materials.The quality and industrial capacity of their technology and process has just been recognized by Frontier, the leading advance market commitment (AMC) initiative worldwide, aiming to accelerate the development of carbon removal technologies by guaranteeing future demand for them. Paebbl, together with Carbon Atlantis as their carbon capture partner, has just been selected in September 2023 as part of the 12 projects, upon 132 candidates, that will benefit from a Frontier AMC.

An innovative solution to reuse and store carbon.

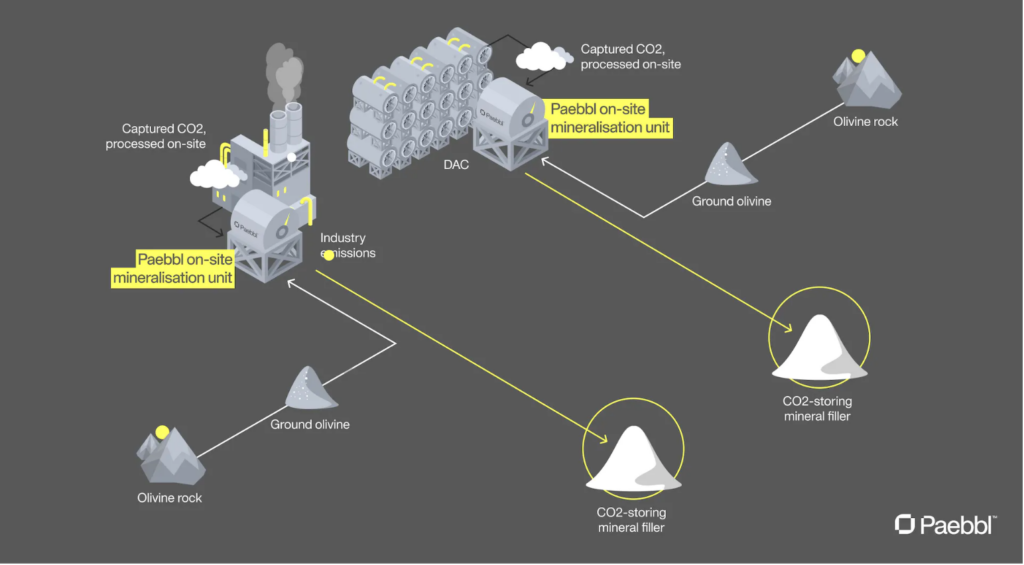

In the face of the urgent need to implement fast and sustainable solutions to combat the climate crisis, Paebbl is focused on the most ambitious task: developing the process of converting captured CO2 into versatile industrial materials and creating the most virtuous loops possible. These materials can be used in various sectors such as construction, paper products, and polymers, replacing highly emitting fossil alternatives.

Specifically, this Swedish-Dutch company, that built its first R&D plant in the Netherlands and is also present in Finland, uses innovative technology that accelerates the conversion of CO2 into synthetic limestone powder and silica powder, providing a viable and environmentally-friendly alternative. This process is inherently energy-efficient, releasing energy instead of using it, making it a major asset in the fight against climate change.

A company that fits with 2050’s climate positive investment strategy

Engaged in a fundamental overhaul of carbon capture and utilization, its mission is deeply rooted in environmental restoration and aligns perfectly with the 2050 European-centric carbon investment strategy.

Using finance as a powerful lever, the 2050 carbon strategy relies on four key steps to support the economy’s climate-positive shift:

- Raise awareness about the environmental challenges by building open shared knowledge ( you can check out our Creative Commons 360° Climate Course here) and enhancing role models

- Track, collect, analyze and value real-life environmental & social data in order to measure and monitor true impact and design future-proof sustainable financial frameworks

- Restore & scale nature-based carbon sequestering solutions and products to augment nature’s carbon sinks (soils and trees, oceans, mineral rocks) capacity and substitute carbon storing solutions to carbon emitting solutions at the same time.

- Reduce carbon footprint through climate positive solutions by implementing industry-specific solutions in heavy emitting industries and building circular and resilient value chains.

Regarding climate transition, both the IPCC scenarios and the 2050 strategy based on the aforementioned open 360° climate course primarily focus on emission reduction. However, it is essential to emphasize that none of these scenarios can overlook the need for large-scale carbon capture and storage. This capture is crucial to offset inevitable emissions, reduce existing greenhouse gas stocks, and alleviate time pressure in the fight against climate change.

At 2050, we are convinced that carbon repurposing represents the most environmentally impactful, scalable, sustainable, profitable and cost-effective approach to carbon capture. By stimulating natural carbon cycles through substituting high-emission materials in industrial production, Paebbl can aim to not only reduce the CO2 level in the atmosphere but also decrease emissions and strengthen natural ecosystems. This will contribute to making our societies more resilient to climate change.

These dual-benefit carbon capture systems, together with the gathering of very strong trans-disciplinary talents bridging the quality, rigor and process expertise of the most efficient industries with the agility, the data-enhanced insights and the entrepreneurial savoir-faire of the startup world, constitute the best strategy for creating a fast-developing, long-term and systemic leader in the carbon market and in climate transition as a whole.

Trans-disciplinarity, alignment and systemic change are at the heart of 2050’s DNA and Paebbl is a magnificent example of all three. Our working together from the very early days of the company’s inception has helped us shape our trust and conviction and drove us to co-lead Paebbl’s €8m seed round together with Grantham Foundation and alongside Pale Blue Dot.

Hunting tomorrow’s champions by meeting aligned founders

No revolution without leaders. In its search for entrepreneurs with systemic ambitions, 2050 seeks to identify those who can disrupt entire industries. By supporting Paebbl, it has identified four individuals, Pol Knops, Andreas Saari, Marta Söjgren and Jane Walerud who stand out for their unconventional background and passion for innovation. Having been in contact with Marie Ekeland long before the birth of 2050 as part of her venture capital previous journey, Marta shares with her and the 2050 team a common ambition: to challenge the conventions of the established world, believing that the traditional investment model will not enable a transition to a fertile world.

More on Marta’s journey to become an aligned founder here.

Thanks to a firmly established relationship of trust with Marta, and regular exchanges with the whole founding team since the beginning of the venture, even before Paebbl’s official inception, Marie and the 2050 team could understand deeply the founders’ drivers and advise on the relevant alignment foundations to be built when structuring the company.

“The process of building a strong trust relationship with the founders was long, but allowed us to act fast once Paebbl’s foundations were laid. Nothing was linear in this approach. Our alignment method to optimize both impact and profit particularly appealed to the founders, as it allowed them to influence other investors and set the right grounds for a future-proof, mission-driven champion” explains Marie, founder of 2050.

During its first round of funding, Paebbl found itself in an oversubscribed situation, forcing it to decline certain investment proposals and ask investors to reduce their commitments. This is how 2050 became a shareholder of the Swedish gem alongside some of the most influential climate investors, all driven by the same desire to support European champions in decarbonization.